Blue Bay:

Passive Investors

Passive investors are always seeking diversified, well vetted investment opportunities. Traditionally these alternative investments have either been "blind pool" debt funds, or high risks equity investments into syndications.

No more. Edwin D Epperson III, manager of Blue Bay Fund I, would like to introduce a rare and highly successful customizable fund, which invests in both debt and equity capital stack options.

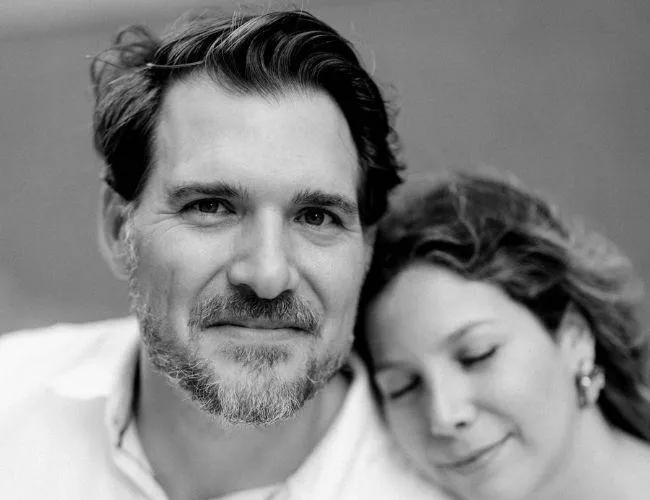

Fund Manager

Edwin D Epperson III

Hello Investor. I wanted to take a quick minute to introduce myself, and give you a brief back ground on my experience, and why dozens of investors have trusted me over the past decade.

I have been investing in private loans secured to investment properties since 2014 when I made my first loan on the side of a mountain, while deployed to Afghanistan.

I served in the US Army from 2002 until 2015 and was honorably discharged after 13.5 years of service, with 7 combat deployments.

During my time in the service I attended and graduated from the toughest and best military schools the Army has to offer: Airborne, Air Assault, Pathfinder, Ranger School, SFAS (Special Forces Assessment Selection), SFQS (Special Forces Qualification Course), SFAUC (Special Forces Advanced Urban Combat Course), CDQC (Combat Diver Qualification Course), and HUMINT Courses. After earning the coveted Green Beret, as an 18E, I operated with ODA7325 a Combat Dive Team.

I currently manage a customizable private debt and equity fund, Blue Bay Fund I, which invest in real estate secured loans to investors across the SE United States, as well equity opportunities in Joint Ventures and Syndications.

I have deployed over $30M of mine and my partners capital into 150+ investments, with a historical average annual return to investors of 9.33%.

I also manage an exclusive, invite only boutique crypto trading fund, which trades on the Kraken Platform, using a proprietary trading methodology co-created with my crypto fund partner, Joshua Weis.

I am an active member of my church The Grove Bible Chapel, in Brandon FL, and I am married to a wonderful woman of God, and Colombiana, Carolina Epperson. I am the father of two boys, no young men, Elijah and Jonathan.

Blue Bay: A Customizable Investing Experience

Investors ask me all the time, "What makes a customizable investment so unique?" There are several reasons why investors are moving away from restrictive one time investments like syndications, or vague and secretive "blind pool funds", deciding to invest in Blue Bays customizable investment experience

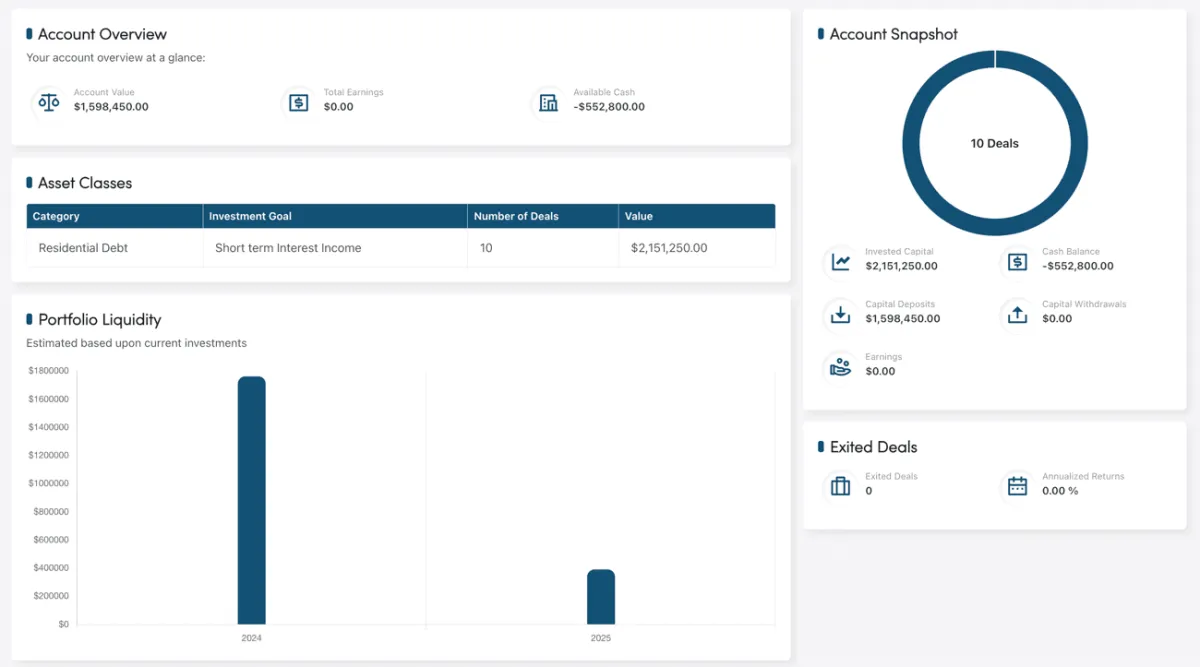

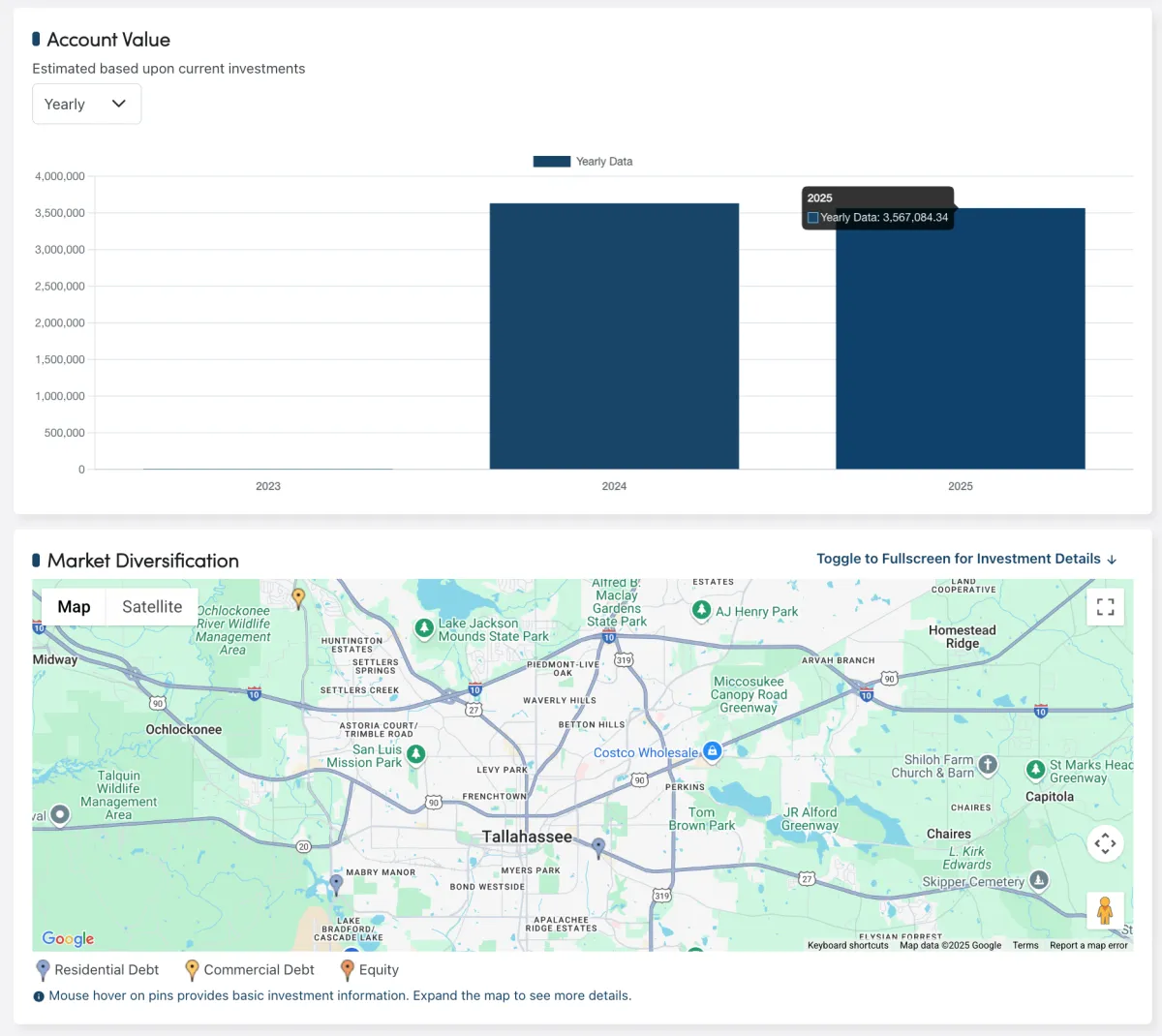

Private 2FA Secured Portal

In a world of fast pace technological advances, secured access to your investment is critical and key. My investors receive a customized and personally secured portal access to their investments, through 2FA securitization.

Rajeev V.

Engineer / Developer

I have had the pleasure of working with Edwin on a couple of deals so far. I found him very professional and authentic. Looking forward to working with him on a lot more deals.

Heather W.

RE Manager/ Owner

Edwin Epperson brings integrity, comfort, and ease to investing in the private lending space. He communicates clearly and patiently with the investor. No question is too small or out of place. This was greatly appreciated as I was unfamiliar with private lending investing. I am in my 3rd year of investing with Blue Bay and the experience has been very positive. Looking forward to future investing.

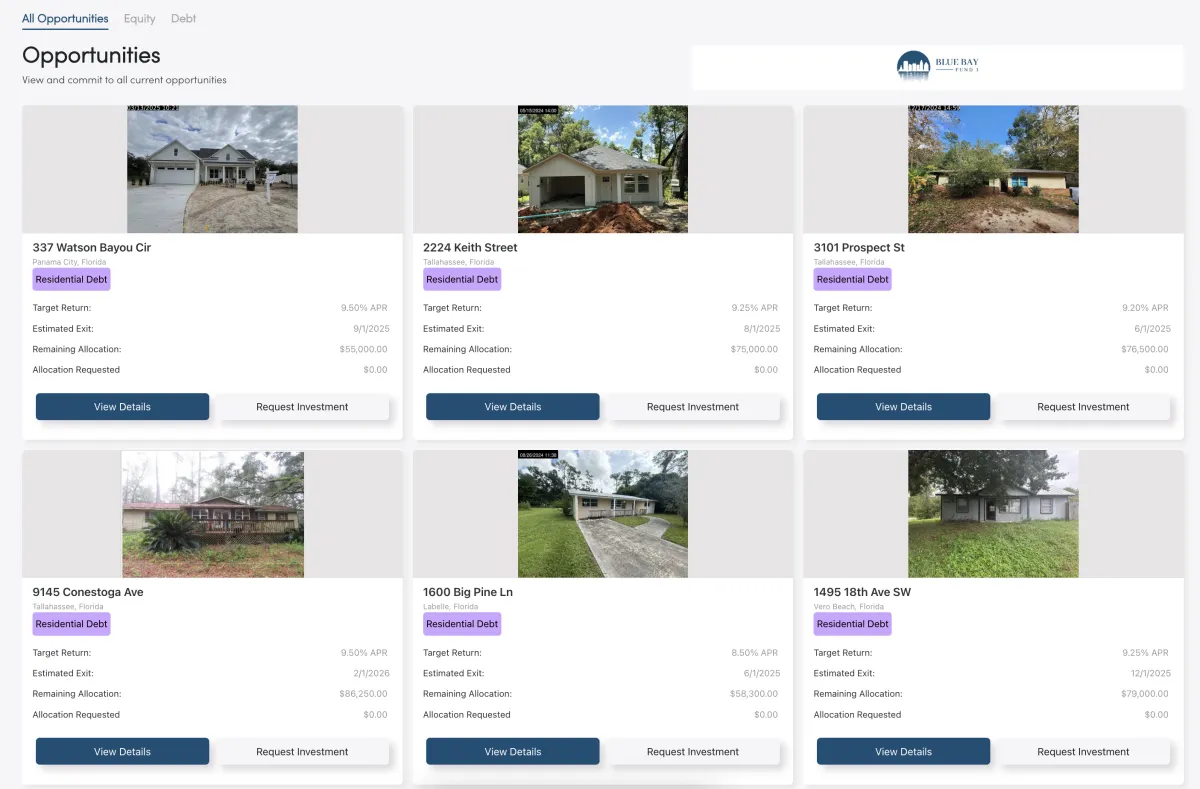

Personally Curated Opportunities

As an investor partnered with Blue Bay, you have the ability to personally select which investments your capital is allocated towards. This dramatically increases your ability to diversify investment asset type, location, and capital stack preferences. Total control, yet completely passive.

Earnings Determined By You

Thats right, you are able to personally select which investments are paying the type of returns you are looking for. My approach is geared toward well-vetted and risk reduced opportunities, and the returns reflect that. However some of my investors require opportunities that have the potential to throw off high double digit returns, and they are willing to assume the risks of those investments for the opportunity to earn high returns. The decision is in your hands though, and the opportunities vast!

Arval H

Business Consultant

It’s been my pleasure to work with Edwin Epperson. He is a man of integrity, prosperity, and an incredible work ethic. He has leveraged his experiences both good and bad to be a steward of community growth and development both in his market and across the nation. Edwin has been a shining example of what it is to be a leader in the private lending community.

Thomas I.

Retired Firefighter

I've been working with Edwin for nearly 10 years, and in every deal I've invested with him, I felt 100% confident that it was a good investment. Edwin has been the most honest investor I have ever worked with. He is completely upfront with you on every deal whether it's going good or bad. He works hard to the very end making sure his investors get paid and offering excellent mortgage investment services. I will continue investing with Edwin and in fact, he is the only one doing lending that I will work with.

100% Manager Invested

One of the most unique aspects of partnering with Blue Bay is the fact that every investment is 100% made with my capital first. When an investor decides to allocate a portion of their investment into an opportunity, what they are really doing is replacing a portion of my investment with their own. Every partner has this full confidence, that every opportunity presented to them, is an opportunity I am 100% comfortable holding myself.

Fractional Capital Allocation

One of the alternative asset industry's greatest hurdle is the large amount of committed investment toward any one particular investment opportunity. I am operating at the tip of the spear for alternative investing strategies. Once a partner joins me in Blue Bay, they have the ability to diversify as little as $0.01 into any one investment! This is true diversification and true fractional allocation of the partners investment dollars.

Jay L

Entrepreneur & Author

I have the highest regard for Edwin's integrity and honesty. When things go great, he shares applause for others’ contributions. When things aren't on track, he jumps in with responsibility to find a solution. There is no other fund manager who does such a good job of due diligence and documentation. Edwin is creative and persistent, two traits essential in an entrepreneur. I highly recommend his investment fund for consideration.

FAQs

Are you looking for more direct answers without having to necessarily reach out to me? No worries I absolutely respect the need for an investor to take measured progress and due diligence in their search for sound, well vetted, highly qualified investments. Who and where you place your invested capital is critical to your families generational wealth.

What is the minimum investment into Blue Bay Fund?

Blue Bay Funds minimum investment requirement is $50,000. However, once an investor is invested in the fund they can move as much or as little money from their account into their fund account at any time. No down times, no delays. 100% in your control.

Who can invest into Blue Bay Fund?

Blue Bay Fund has a filing with the SEC to offer non-registered securities under Regulation D, Rule 506(c). This allows us to publicly market and advertise the fund, and its returns to the general public. Because of our filing, and public solicitation capability, we can only accept accredited investors.

What is the lockup period for invested capital?

For most investors who are used to investing in a syndication, where their capital can be locked up for 3, 5 or even 7 years, I wanted to provide more flexibility. I know of an investor who is invested in a syndication gone South and he's been locked in for 10yrs now! With my fund lockup period being only 24 months, this gives my partners the maximum flexibility in a space that traditionally is much longer.

What type of returns should I expect as an investor in Blue Bay Fund I?

This is where the power of our customizable fund comes into play. Every investor knows that when they invest into Blue Bay Fund, they will be exposed to a wide variety of real estate opportunities on both sides of the capital stack. This means you will be able to invest in debt and equity opportunities. Debt opportunities are typically broken down into Senior Debt (1st position secured liens) and Junior Debt (2nd position secured liens), while my Equity opportunities come in the form of Joint Ventures and Syndications. Debt opportunities can range from 8% - 15%, while Equity opportunities can range from 18%+! So really the question of how much can you expect to earn is dependent upon your tolerances for risks, and how diversified you would like to be.

How do I file my taxes?

I have worked extra hard to ensure that my partners have simplified and stream lined tax preparation. The fund issues a K1 for each investor, regardless of the types of investments you invested in. Debt and Equity investments and their returns are all reported on one K1. I also work very diligently to have the returns to our investors well before April the 15th, which reduces the stress of coordinating with your tax preparer to file extensions.

Have you ever had an investment go bad?

Yes I have. While I do not "brag" about the deals that have gone bad, I'm very open to discussing the circumstances around those deals. Since 2014, when I made my first loan while deployed to Afghanistan, we have had a default rate of only 0.40%. The industry standard, in secured private credit is 5-7% as an acceptable default! So I would say I've been doing alright by my investors. Here is the good thing. Even in the case of a default, I personally handle the retainer of the attorney and all foreclosure fees. Why? Because in debt we always have protective equity. And that protective equity will not only pay me back the costs of filing the foreclosure, but also unpaid interest.

How soon am I able to invest?

I'm glad you are so enthusiastic! My fund is also unique in this, that there are not "windows" for investors. We are always closing on loans and making investments, so the question is how soon would you like to be able to invest?

Testimonials

Dion M. - Real Estate Attorney

"I have the pleasure of representing Edwin and his company for various investment deals he puts together. He has a strong work ethic and is very meticulous. I am also impressed by his professionalism and integrity. I highly recommend Edwin and Blue Bay Fund if you are considering any sort of involvement with private mortgage investing."

Kathy W - Family Investor

"Edwin was highly recommended by a fellow investor. He goes above and beyond to make sure we understand the investment. He has been a secret source to increasing our capital. I am always confident when I invest with Edwin because he has done his due diligence in underwriting the account. I know he has done his homework before he releases another investment opportunity to me. He is knowledgeable of the market and we are thankful for doing business together.

Pamela E. - Military Spouse

"I have invested with Edwin since 2020, and throughout this time he has kept an open line of communication. All investments are subject to risk, but his due diligence helps me feel that my funds are secure."

Tom C. - Insurance Business

"Edwin has the integrity that I look for in a business partner. It's apparent that he behaves like the military elite should - Bold, Confident, Organized, and Studied. He does his due diligence and in the rare event of a deal going South, he owns up to it and most of all, he learns from it. He insulates the damage to his associates to the greatest degree possible. Investments don't always go as planned, but when the going gets tough, I'm glad that Edwin is managing the project."